cryptocurrency tax calculator us

Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

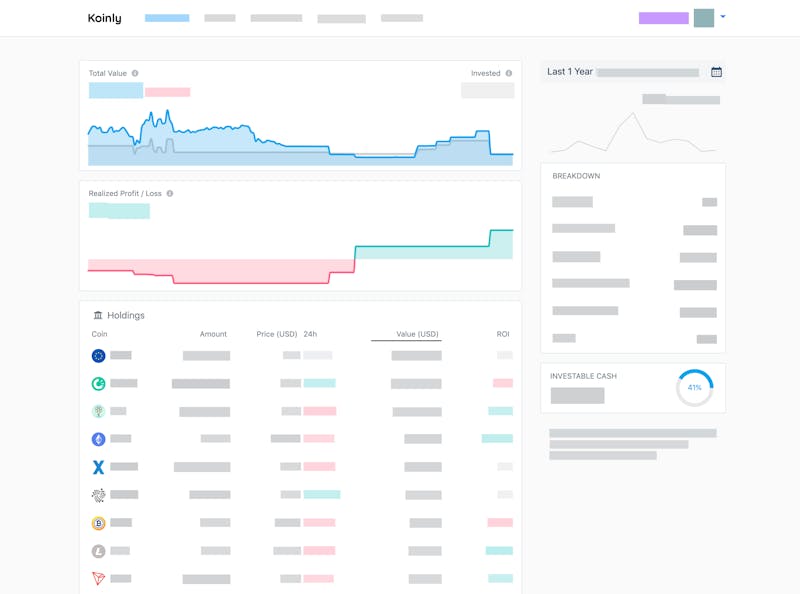

How To Do Your Binance Us Taxes Koinly

They compute the profits losses.

. Divide the initial investment amount. Try It Yourself Today. What is a Crypto Tax Calculator.

The purchase date can be any time up to December 31st of the tax year selected. Simply The 1 Tax Preparation Software. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any.

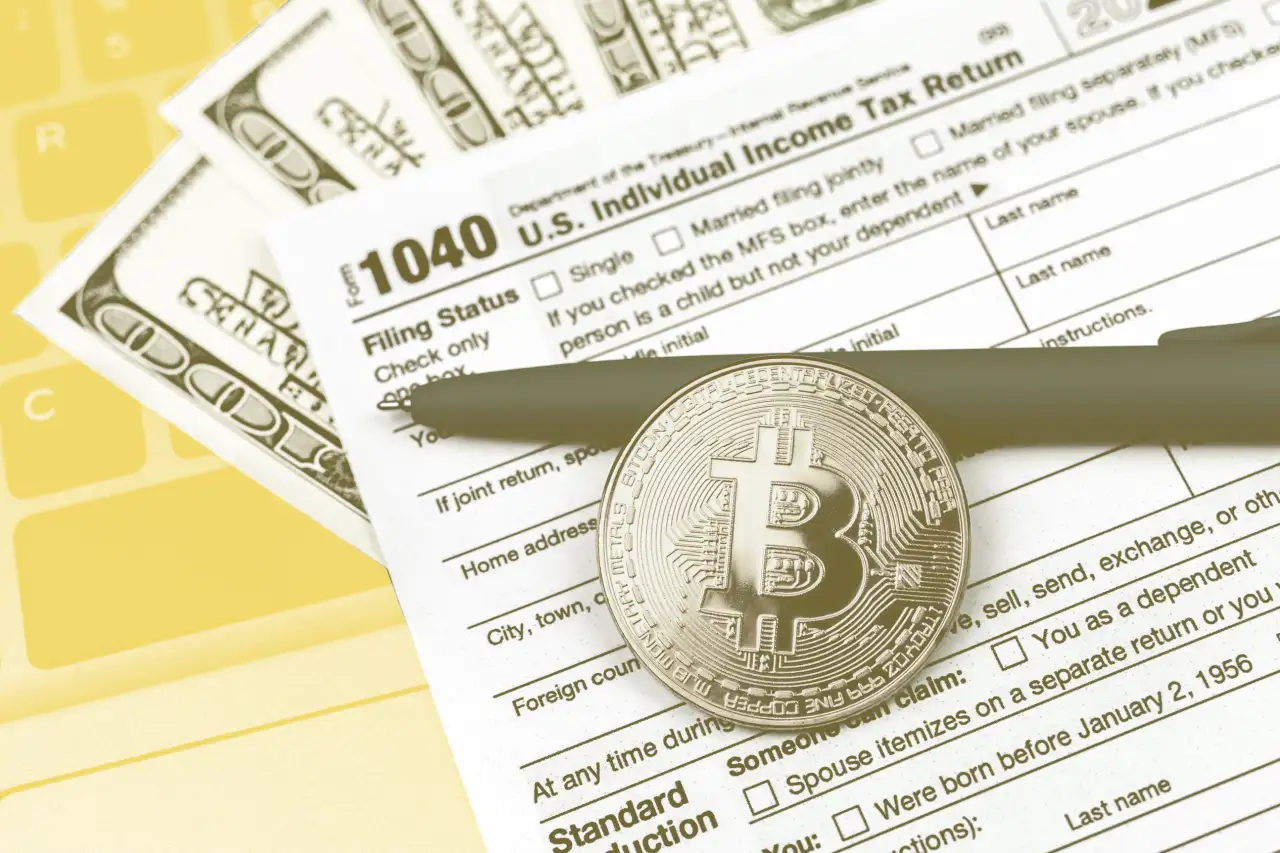

Yesproceeds from cryptocurrency trades are taxed as capital gains. Enter the sale date and sale price. Ad Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms.

ATO Tax Reports in Under 10 mins. Take the initial investment amount lets assume it is 1000. According to a May 2021 poll 51.

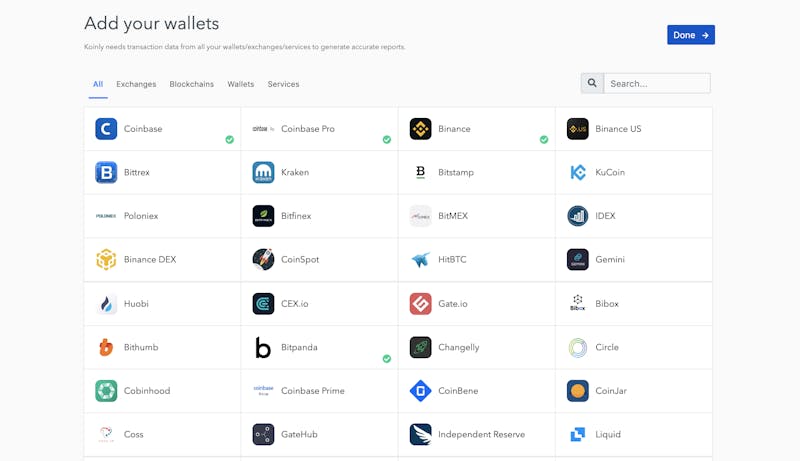

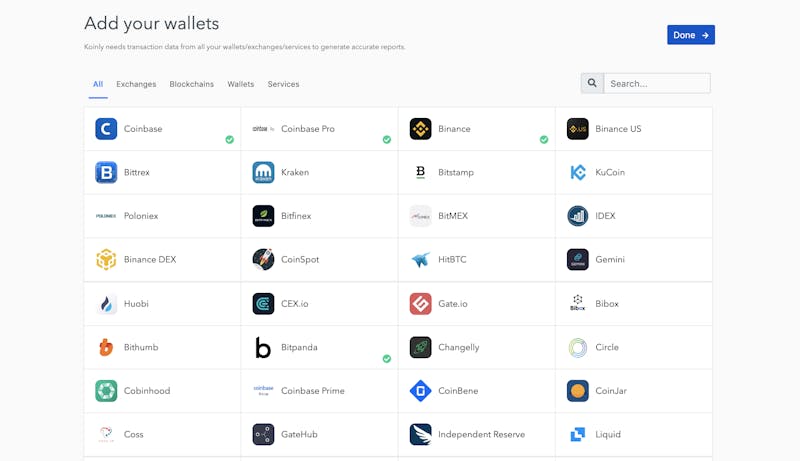

It had claimed that it was the governments sovereign right. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. ZenLedger is a crypto tax software that supports integration with more than 400 exchanges including 30 Defi Protocols.

Free Crypto Tax Calculator for 2021 2022. This is a simplified calculator to help you calculate the gains of your cryptocurrency. The calculator is based on the.

Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give. 17 2022 to file. Import your cryptocurrency data and.

Long-term capital gains. For crypto assets held for longer than one year the capital gains tax is much lower. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax.

Blox supports the majority of the crypto coins and guides you through your taxation process. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. Your gain is the amount youll be obliged to pay taxes on.

We offer full support in US UK Canada Australia and partial support for every other country. In this article we go over the main features of a cryptocurrency tax calculator. You can use this calculator to get a quick estimate of the taxes you may owe.

The popularity of cryptocurrencyBitcoin investments continues to skyrocket. But how much tax do you have to pay. Ad Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Valid from 1126 to. Use code BFCM25 for 25 off on your purchase.

The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and l ong term capital gains. The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and long term capital gainsThe calculator is based on the. Enter the purchase date and purchase price.

2021 was a big year for. The government had proposed a 30 per cent tax on the sale of cryptocurrency in Budget 2022. Heres an example of how to calculate the cost basis of your cryptocurrency.

10 to 37 in 2022 depending on your federal. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. 15 Best Crypto Tax Softwares Calculators in 2022.

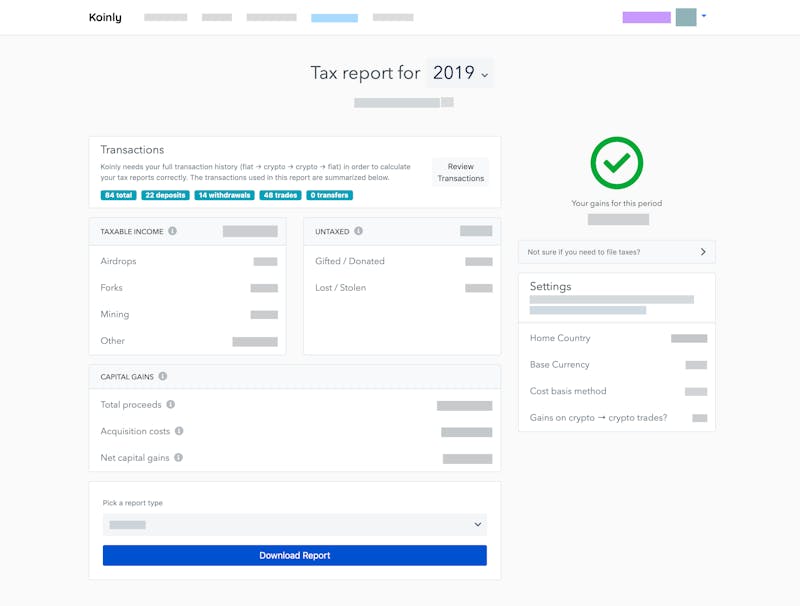

You simply import all your transaction history and export your report. Try It Yourself Today. The federal short-term capital gains crypto tax rate ranges from 10-37 the same rates as income tax.

Straightforward UI which you get your crypto taxes done in seconds at no cost. Stop worrying about record keeping filing keeping up to date with the evolving crypto tax. This guide details the tax obligations for crypto investors and answers many commonly asked questions on a wide range of scenarios that may apply to your crypto.

Simply The 1 Tax Preparation Software. With more than 15K customers this. April 18 was the last day to file your 2021 taxes or request an extension to file.

0 15 or 20 tax depending on individual or combined marital. US Tax Guide 2022. In this scenario your cost basis is 10000 and your gain is 5000.

There are cloud-hosting tools specifically designed for crypto miners. This means you can get your books. If you requested an extension youll have until Oct.

Cryptocurrency Tax Calculator The Turbotax Blog

How To Calculate Crypto Taxes Koinly

Calculate Your Crypto Taxes With Ease Koinly

How To Calculate Cost Basis In Crypto Bitcoin Koinly

10 Best Crypto Tax Software In 2022 Top Selective Only

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Cryptocurrency Tax Calculator 2022 Quick Easy

Understanding Crypto Taxes Coinbase

Bitcoin Tax Calculator Taxact Blog

5 Best Crypto Tax Software Accounting Calculators 2022

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Cryptocurrency Taxes What To Know For 2021 Money

Cryptocurrency Tax Calculator The Turbotax Blog

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Reports In Minutes Koinly

Calculate Your Crypto Taxes With Ease Koinly